Unlock Lush Returns by Collective Investing

Earn upto 25% Annual Return. Own Assets Fractionally

Access an Inner Circle of Savvy Investors

Power of Community

As the old adage goes, lions hunt together — and so do wealthy individuals when they invest. The wealthy don't compete; they collaborate on large opportunities to create lasting wealth. Our platform empowers you to network with other savvy, like-minded investors, building lifelong collaborations that lead to success.

Accessibility

Enjoy upside on deals that were earlier only available to ultra-HNIs, thanks to the combined investing power of the community

Curated Deals

Crowd-sourcing

of deals from within the community, multiplies our power to spot promising micro-markets across regions at an early stage

Diversification

Investing in a single high-ticket real estate asset is fraught with risks. Building a portfolio of fractional investments in multiple assets diversifies risks

Our Products

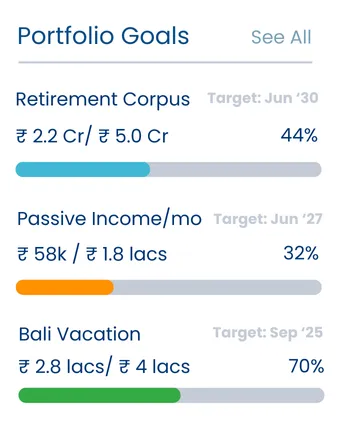

Align Your Portfolio with Your Life Plans

Your financial journey is unique, shaped by personal aspirations and life milestones. By aligning your investment portfolio with your specific goals—be it planning for retirement, funding children's education, buying a new home—you ensure that each investment decision supports your broader life objectives. This strategic approach involves assessing your risk tolerance, setting clear time horizons, and selecting assets that match your financial targets. Based on that, we have three investment products:

BluTribe ContinuumTM for planning your early retirement

BluTribe QuickFlipTM for high-return, short-term investment

BluTribe AlchemyTM for creating generational wealth

Live Investment Opportunities

BLU TRIBE Continuum™

✔ Earn upto 12% Yields FOREVER

✔ Perfect to Plan Early Retirement

✔ Option to Exit after Year 5

Continuum™ empowers you to build a portfolio of fractional shares in high rental yield assets—delivering steady monthly income to comfortably fund your lifestyle and cover living expenses.

At the same time, your principal grows at a rate above inflation, helping you preserve and expand your wealth over the long term. That means true peace of mind—

knowing you'll never outlive your portfolio.

Housing for Industrial Workers, Harohalli, KA

Asset Specs: 48 Units of 350 sq ft each

Min Investment: ₹20 Lakhs

Target Rental Yield: 8 %

Target IRR (5 Year): 18-20 %

Asset Value ₹ 4.2 Crores

Holding Period: Perpetual. Option to Exit at Year 5

Financial Goal : Retirement

Students Accommodation, Kanakpura Road, KA

Asset Specs: 44 Beds Complex

Min Investment: ₹15 Lakhs

Target Rental Yield: 10 %

Target IRR: 20-22 %

Asset Value: ₹ 2.8 Crores

Holding Period: Perpetual. Option to Exit at Year 5

Financial Goal : Retirement

BLU TRIBE QuickFlip™

✔ Experience Capital Growth of upto 25% in 12 Months

✔ Investment in Pre-Launch Projects of Grade-A Builders

✔ Great for Short-term Investment

QuickFlipTM allows you to join our investor pool to tap into pre-launch properties by Grade A builders—pay just 30% upfront, and capture 20–30% capital gains in 12–15 months.

We buy early, ride the appreciation wave, and exit before the next payment tranche—maximizing ROI with minimal capital. No loans. No construction risks. Just smart timing.

Sattva Springs, South Bangalore, KA

Asset Type : Luxury Row House

Min Investment : ₹25 Lakhs

Target IRR : 25 %

Asset Value : ₹ 6.4 Crores

Purva Zentech, Bangalore, KA

Asset Type : Office Space

Min Investment : ₹25 Lakhs

Target IRR : 25 %

Asset Value : ₹ 6.7 Crores

BLU TRIBE

Alchemy™

✔ Traditional Private Equity Deals

— ticket size ₹ 50+ Lakhs

✔ Investment in high-upside greenfield real estate projects

✔ Build Generational Wealth

We acquire underpriced assets in emerging locations, then develop them into high-demand properties such as villas, holiday homes, or managed farmlands—based on consumer trends and end-user demand. By building and branding thoughtfully, we unlock significant value from the ground up. Investors gain access to private equity-style returns without the complexity of traditional large-scale deals.

Managed Farmland Project, Ramanagara, KA

End Use: Farmland with Wooden Cabin as Weekend Homes

Total Area: 6 Acres

Min Investment : ₹50 Lakhs

Target XIRR : 40 -45%

Seed Capital : ₹ 8.5 Crores

Holiday Homes Project, Niligiris, TN

End Use: Holiday Homes that double up as bed-and-breakfast when not in use

Total Area: 3 Acres

Min Investment : ₹50 Lakhs

Target XIRR : 40 -45%

Seed Capital : ₹ 4.2 Crores

Who We Are

Just like you, we are Investors chasing alpha

We are a team of seasoned professionals with strong pedigrees and deep experience across asset management, private equity, investment research, and real estate development. In addition to being sharp asset managers, we operate our own dedicated real estate development division, giving us end-to-end control over investment opportunities — from acquisition to execution.

Nothing excites us more than achieving outsized returns. And we invest alongside you and other investors so that we have skin in the

Tailored Investment Solutions

Expertise You Can Trust

50+

Years of combined Experience

BLU TRIBE Alchemy™

Traditional Private Equity Deals | Value Addition Projects for ₹ 50Lakhs Lot-size

Managed Farmland Project, Ramanagara, KA

Min Investment : ₹50 Lakhs

Target IRR : 40 %

Seed Capital : ₹ 9.5 Crores

Villa Project , Kanakpura Road, KA

Min Investment : ₹50 Lakhs

Target IRR : 55 %

Seed Capital : ₹ 12.8 Crores

Co-Farmhouse Project, Ramanagara, KA

Min Investment : ₹50 Lakhs

Target IRR : 50 %

Seed Capital : ₹ 8.5 Crores

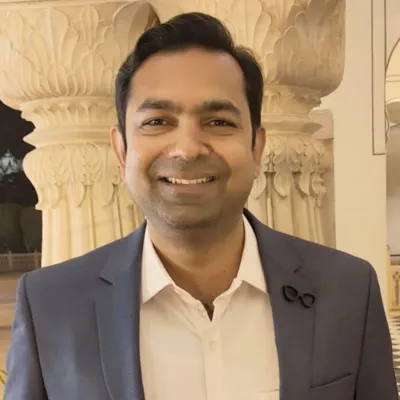

Meet the Team of Professionals

Manas Nanda

Manas is an experienced finance professional, and has worked with S&P, CRISIL, Deutsche Bank, World Bank, performing investment research on equities, bonds . He has a B-Tech from IIT (BHU), MBA from University of Oxford and is a Chartered Financial Analyst. His initiatives have been covered in Forbes, the Hindu among others and have been awarded by United Nations, and Govt of India

Ravi S Phutane

Originally a pharmacist by qualification, Ravi has a vast array of experience in starting and scaling businesses spanning pharma, hospitality and real estate sectors, managing sales, marketing and operations. He has spent over 15 years in developing boutique real estate projects, particularly in the Nilgiris areas. At BluTribe Capital, he manages land acquisitions, legal due diligence and operations .

Abhishek Kumar

Abhishek is a seasoned product and global operations manager with over 13 years of corporate leadership and expertise in the construction technology sector, both in India and the US. He has a Masters in Civil Engineering from Purdue University, US and a B-Tech in Civil Engineering from IIT (BHU). At BluTribe Capital Abhishek lends his expertise in designing real estate products that maximise value for end-user.

Sagar Bhutada

Sagar has over 15 years of experience working, starting and leading in corporates, SMEs, new-age start-ups and family-owned businesses. Having worked both in CFO and later in CEO positions, he has deep strategic and financial insights. As a Chartered Financial Analyst and a Chartered Accountant, he brings expertise in deal structuring and investment appraisal for transactions

Products Based on Financial Goals

Whether it's early retirement, funding your child's education, or achieving other life milestones, we curate investment products tailored to your financial goals

Competitive Asset Management Fees

Traditional asset management costs are high for smaller investments. Our tech-driven platform reduces these costs by over 60%, making smart investing more accessible

Dedicated Portfolio Manger

Investing doesn't have to be overwhelming. Our dedicated portfolio managers make it simple and stress-free. Access portfolio performance anytime

What Client Say

Here's what our clients have to say about their experience with our investment services:

The personalized attention and expertise I received helped me achieve financial growth I never thought possible.

Samir Rajguru

IT Professional

Working with their team has transformed my financial outlook—they truly understand my goals and needs.

Laxmi Ranganath

Marketing Consultant

Their strategic approach to managing my investments has given me peace of mind and consistent returns.

Sudhir Sharma

Business Owner

Frequently Asked Questions

What types of investment products do you offer?

We offer a range of real estate backed investment products to suit your financial goals such as retirement planning, wealth preservation, funding child's education or marriage, using financial strategies tailored to your unique goals.

How do you determine the best investment strategy for me?

We begin by assessing your financial goals, risk tolerance, and time horizon. Based on this, we create a customized investment plan designed to maximize returns while minimizing risk.

What is the minimum amount required to start investing with your firm?

Minimum investment requirements vary depending on the products you choose. We offer flexible options to accommodate different levels of investment, from individuals to high-net-worth clients.

How often will I receive updates on my investment performance?

We provide regular reports on your portfolio’s performance, and our advisors are always available to discuss your investments. You can also access real-time updates through our online platform.

How does it work legally?

A special-purpose vehicle (SPV) is made in the form of an LLP or Pvt Ltd and all co-investors are made shareholders of the SPV. The asset is owned by the SPV and all cashflows earned by the SPV from rentals or sale of asset is passed on to individual share-holders in proportion of capital invested.

What happens if an investor wants a pre-mature exit?

For our QuickFlipTM and AlchemyTM products, pre-mature exit is of low relevance as the holding period itself is low 12-18 months). For our ContinuumTM the holding period is high and we recommend that investors have a minimum of five year exit horizon for this product. In case of pre-mature exit, we recommend giving us three months of notice, so that we can find another investor who can buy out your share in the SPV.

Your trusted partner in financial growth and investment success, committed to securing your financial future.

Quick Links

Home

About Us

Services

Useful Links

Testimonials

FAQs

Blog